However, Option Chain analysis can also be applied to stocks, especially the top stocks that are a constituent of the Nifty index. Let us take the example of Reliance Industries Ltd, which is India’s largest company by market capitalization. So we can conclude that if we combine the chart with the option chain study then we can get a different level of conviction.

Nine back-tested intraday trading strategies were discussed in this book. To name a few are opening range breakout, super trend, MACD, gap strategy, chart pattern strategy etc. In the options chain, we will find two implied volatilities, one for the bid and another one for the ask price. Typically, you will find that the buying side has higher volatility compared to the selling side. We should be aiming to find, at least, a minimal volume of one hundred contracts exchanged in the options chain. Let us suppose that we have a stop loss placed over an options contract that has almost no option volume.

Another example,May be a strategy might involve buying in the money contracts and then writing out of the money contracts on the same underlying security. If both Call and Put option writers are reducing their positioning in lower-priced strikes and are increasing their positioning in higher-priced strikes, it means supports and resistances are both shifting higher. This is an indication that the trend of the underlying is strengthening.

Best Real Estate Books

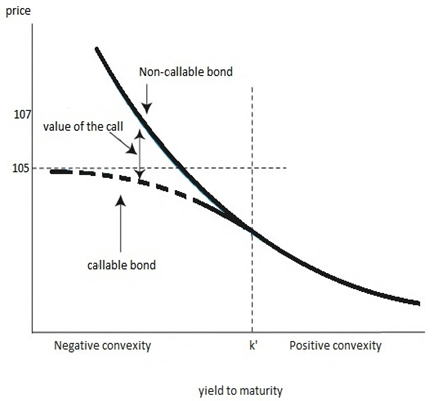

As an illustration let us choose Nifty Option chain and analyse the data. The Option chain data of the Nifty is specifically useful considering that it is one of the most liquid contracts and weekly options are also available on the same. In this Chapter, we will study about some of the important concepts that we have not studied so far in the Options Module. It is equally important to understand each of these concepts, as they are extremely useful, especially when trading options.

In this article, I am going to discuss the Option Chain Analysis in Trading. Please read our previous article where we discussed Opening Range Breakout with examples. At the end of this article, you will understand the following pointers in detail which are related to Option Chain Analysis. In the above Option Chain of Reliance Industries, notice that in case of Calls, maximum writing is at 1500 followed by 1600; whereas in case of Put, maximum writing is at 1440 followed by 1400. Break below 1440 would open door for further fall towards the 1400; whereas break above 1500 would open door for a rally towards the next hurdle of 1600. So far, we have talked about Option Chain analysis pertaining to Nifty and Bank Nifty.

A skilled user can quickly decipher the market regarding price movements and where high and low levels of liquidity occur. For efficient trade executions and profitability, this is critical information. Conversely, options with more time remaining until expiry have more opportunities for the stock price to move beyond the strike and be profitable. As a result, options with more time remaining typically have higher premiums. We don’t care what your motivation is to get training in the stock market.

The greeks on the options chain

Once you understand the option chain, your option trading stratergy and money making skills in share market will certainly improve. Understanding option chain gives you a clear idea about choosing best strike prices like, In the Money (ITM), At the Money(ATM), Out of the Money(OTM). Options trading is particularly popular with traders who regularly trade the commodity futures markets. Widely recognized as an authority on derivatives, futures and risk management, Hull has served as a consultant to many of the best-known investment banking firms. Consequently, his book contains actionable information on swaps and other derivative instruments, trading interest rate futures and strategies for estimating the time value of options. “Covered Calls for Beginners” from Freeman Publications looks at options trading as collecting “rental income” from securities you already own.

DC Arts Center Boosts Local Artists While Hiding In Plain Sight – DCist

DC Arts Center Boosts Local Artists While Hiding In Plain Sight.

Posted: Tue, 01 Aug 2023 13:46:00 GMT [source]

For example, risk management, the relation of options to their underlying assets, volatility, and options pricing. If you are looking for free courses on trade options, look no further than our online trading courses. We have seen how Option Chain can be used to get a holistic picture of the underlying asset that is being monitored. However, we would like to caution the reader that Option Chain is not a substitute for other forms of analysis, such as Fundamental and Technical analysis.

Top Trending Posts on Astha

As we have already seen in this article about the most common expiration dates typically, contracts expire on the third Friday of each month. In any case, we should expect a difference of 4 to 5% between the bid and ask for those options chain that has the highest volume. In order to analyse the option chain data, first you need to know basics steps involved. Let us go step by step to know where we can find the option chain list.

Traders can find an option premium by following the corresponding maturity dates and strike prices. Depending on the presentation of the data, bid-ask quotes, or mid-quotes, are also displayable within an option chain. Often doled out as required reading for those in the field, Sheldon Natenberg’s “Option Volatility and Pricing” is a solid choice for both amateur and professional traders looking for success in the options market. Each day our team does live streaming where we focus on real-time group mentoring, coaching, and stock training. We teach day trading stocks, options or futures, as well as swing trading. Our live streams are a great way to learn in a real-world environment, without the pressure and noise of trying to do it all yourself or listening to “Talking Heads” on social media or tv.

The 8 Best Options Trading Books of 2023

The first column will show us the volume of contracts that are being traded. As with the stock trading volume, the options volume is vital to understand how liquid the trade will be and how easy is to open or close a trade. As a matter of fact Even if you are just using very simple strategies like taking a single position, you still need to consider moneyness. Understand this every options trading strategy requires knowing what moneyness state the options you are buying or selling (writing). The seller (or writer) is obligated to sell the commodity or financial instrument should the buyer so decide.

When trading an option, it is important to ensure that there is enough liquidity among the option contracts that one wants to trade. Trading an asset that is not liquid is risky because of various factors such as choppy price movements, high transaction costs, difficulty in entering and existing books on option chain analysis trades at the desired price and time, etc. There are a few ways to check for liquidity and one of them is to look at the volume and open interest statistics of an option contract. Well, volume and open interest are two different concepts, yet are very closely related to each other.

- This is why an investor should have the right information, real market data, and facts that will help them make the right decisions on trading options before investing in any option types.

- As OTM Calls have strikes that are above the underlying price, the strike price of OTM Calls often acts as resistance for the underlying price.

- Once it has been visually determined that an option contract has decent volumes and hence is tradeable, a trader can then use volumes to validate trading signals.

- In fact, this is another reason why it is important to track the Option Chain.

- On the flip side, supports shifting higher and resistances shifting lower, or vice versa, indicate indecisiveness about the trend of the underlying.

According to complaints from some readers, this book doesn’t provide much in-depth information about the world of options trading. Nevertheless, it is still a great book for anyone who has never done options trading or has only a little experience in the field. In this guide about how to read an options chain, we have covered everything we need to know to understand how to properly trade them. If you need to check the data provided by the option chain, every options trading brokerage offers that information. To be able to learn how to read an option chain correctly, we are going to break it down and analyze every data displayed.

Let us now see what these two variables represent and why it is so crucial to understand them as well as to monitor them when entering an option trade and after having entered an option trade. For our discussion henceforth in this chapter, keep in mind that when we talk about volume and open interest, we are talking about them for option contracts only. If you’re only going to read one book on options trading, let it be this one. Mark Wolfinger’s “The Short Book on Options” covers not just the basics of options trading, but strategies for utilizing this sector of the market with minimal risk, of course.

Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits by Dan Passarelli

Once it has been visually determined that an option contract has decent volumes and hence is tradeable, a trader can then use volumes to validate trading signals. Generally, the higher the volume, the greater is the trading interest in the option contract and vice versa. In technical parlance, it is often said that volume goes with the trend. For instance, an up move in option price that is accompanied by an increase in volume is considered as a bullish signal, because it indicates at an increase in buying interest.

Inflation drives up cost of back-to-school items; local families look for … – Dayton Daily News

Inflation drives up cost of back-to-school items; local families look for ….

Posted: Sun, 30 Jul 2023 10:02:21 GMT [source]

Straddle, strangle, calendar spread, call spread, put spread etc. were explained with payoff charts. At 113 pages, it is just long enough to provide you all the information you’ll need to start trading. However, you won’t find a lot of factual and detailed information in the book. The information offered in this book comes from a professional perspective.

We can see at the beginning of the trading session only, that prices fell and broke the 11,300 level, the buying again came but wasn’t able to cross that price. One should notice the strike price in which the open interest is maximum. Formerly a market maker, Wolfinger is the author of three options books and operates Options for Rookies. The Bullish Bears team focuses on keeping things as simple as possible in our online trading courses and chat rooms. We provide our members with courses of all different trading levels and topics.

Volume measures the number of transaction that took place on each options contract for that day. If a particular stock options contract is bought or sold 1000 times in a day, its volume will reflect 1000. Basically, higher the volume of a stock options contract, higher its liquidity. It is another indicator of traders interest in a particular strike price of an Option.

This is an indication that the trend of the underlying is weakening.So, supports and resistances both shifting higher is bullish whereas both shifting lower is bearish. On the flip side, supports shifting higher and resistances shifting lower, or vice versa, indicate indecisiveness about the trend of the underlying. As can be seen from the above table, if a buyer and a seller are both establishing a new position, open interest increases by 1 contract. On the other hand, if a buyer and a seller are both closing out their existing positions, open interest reduces by 1 contract.